Forex Robotron automates Forex trading. An expert advisor (EA) or forex robot, it uses MetaTrader to make choices using predetermined algorithms. The benefits and downsides of Forex Robotron are listed below:

Pros

- Automation: Forex Robotron automates trading choices, saving traders time and mental stress.

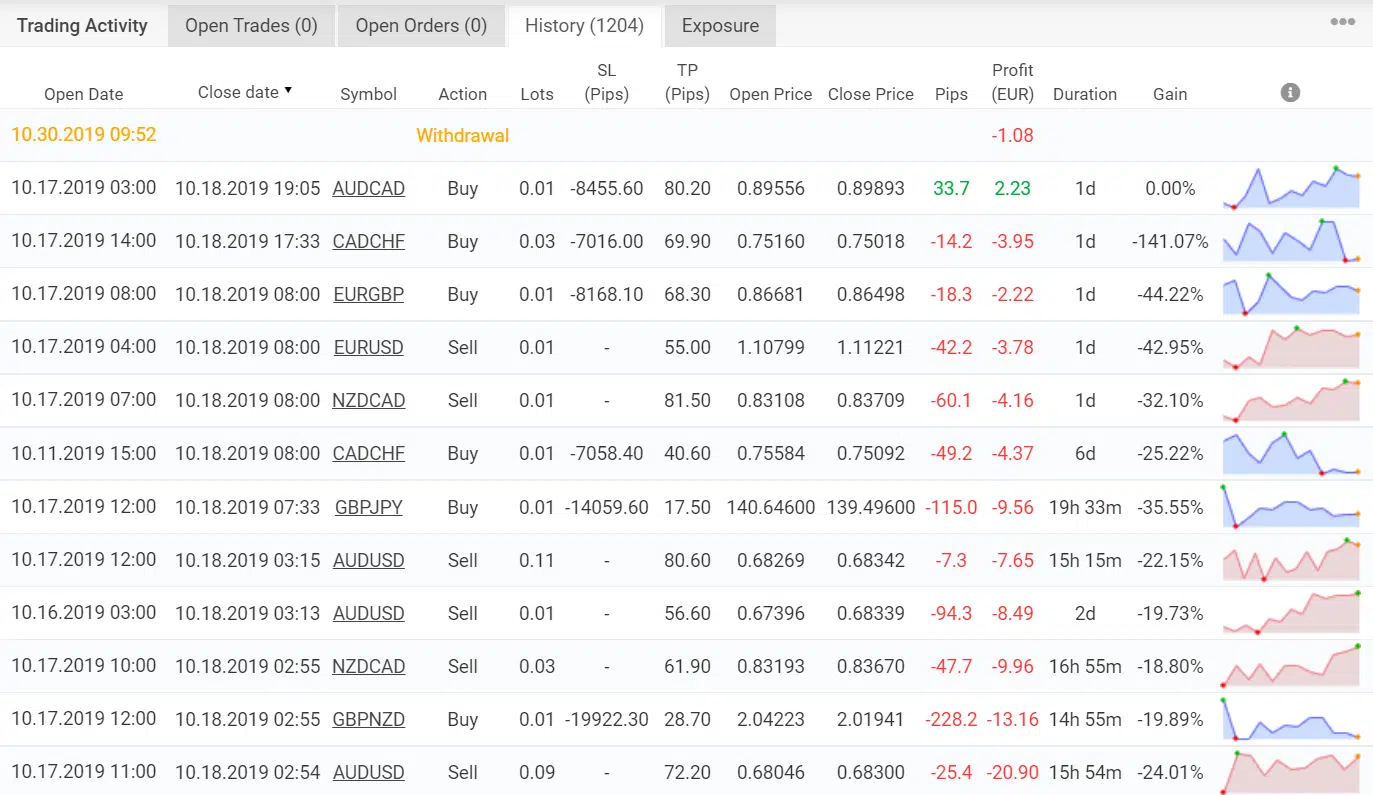

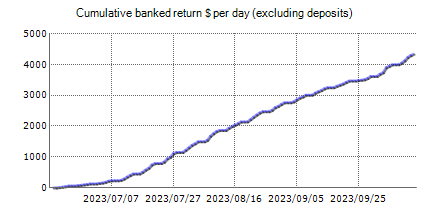

- Backtesting Results: The program generally performs well in backtests against historical market situations, suggesting its potential.

- Forex Robotron is straightforward to set up, even for non-techies.

- It works with several currency pairings, giving traders flexibility in different Forex markets.

- Customizable Settings: Users may tailor risk levels and tactics to their trading preferences.

Cons

- Market Dependence: Forex Robotron’s performance relies on markets. It may work better in certain markets than others.

- Constant Monitoring: Despite being automated, it needs constant monitoring to maintain proper operation and market adaptation.

- Over-Optimization: The robot may be over-optimized for prior market circumstances, which may not guarantee future success.

- Like any trading method, there is no profit guarantee. Past performance doesn’t necessarily predict future success.

- Software Glitches: Software may develop technical faults that can impact trading choices if not handled immediately.

Conclusion

Forex Robotron automates Forex trading, which may save time on market research and trading. Advantages include its easy-to-use UI and configurable settings. Users should be aware of its market dependency and automated trading hazards. Understand that no automatic method can guarantee profits and Forex trading is risky. Forex Robotron should be used as part of a diversified trading strategy, not simply for trading choices.