Tool selection is crucial in forex trading. The “Forex Gump” Expert Advisor (EA) is popular for automating trading methods. The “Forex Gump” EA’s characteristics, advantages, and concerns for forex trading are covered in this article.

New Forex Gump EA

The algorithmic trading program “Forex Gump” helps traders execute forex trading methods automatically. To take advantage of market possibilities, the EA analyzes trends, price movements, and technical indications.

Features and Functions

The “Forex Gump” EA has a simple UI and several features:

To find trade settings, the EA uses complicated algorithms that combine technical indicators, price patterns, and market research.

Flexible Strategies: The EA may be customized to match traders’ trading strategies, risk tolerance, and market circumstances.

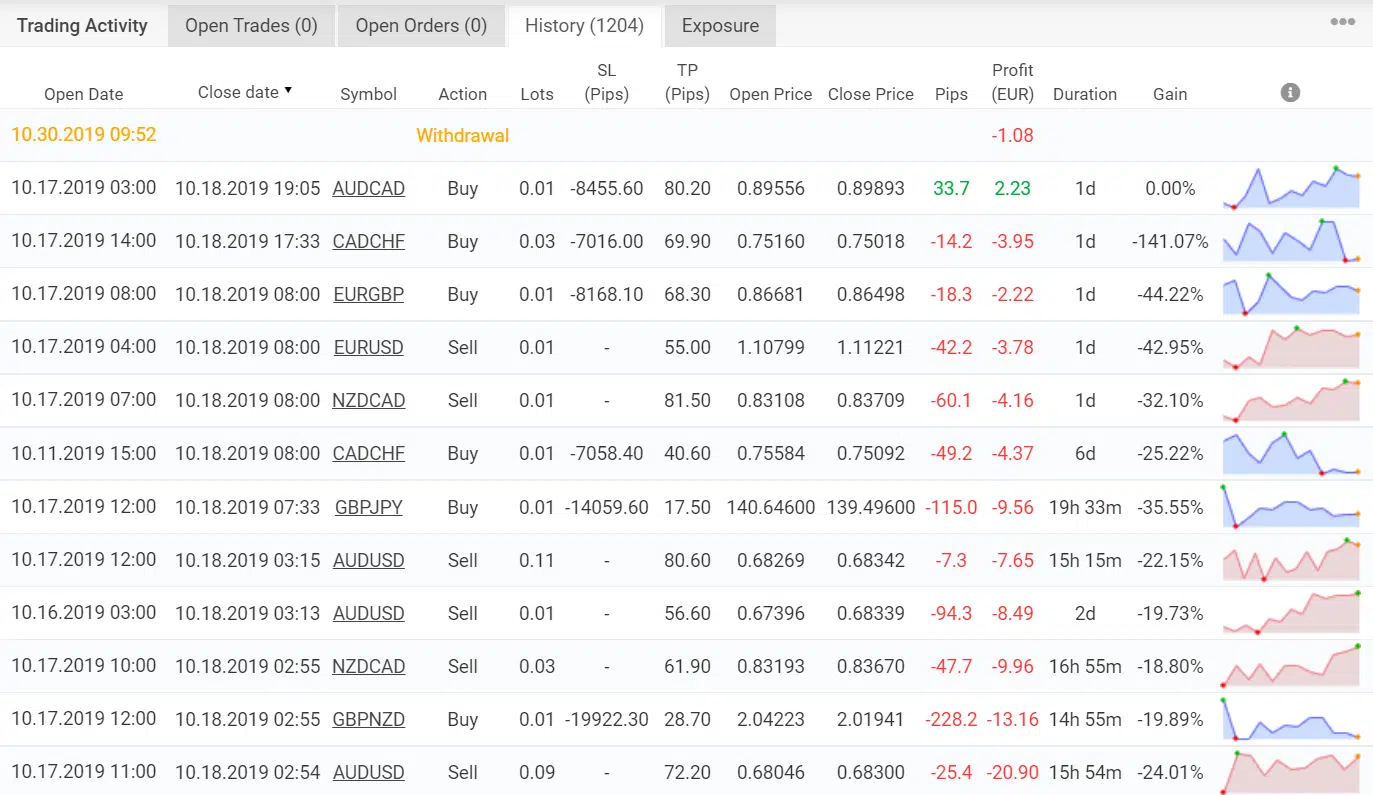

Risk Management: To safeguard money and manage trades, the EA provides Take Profit and Stop Loss settings.

Multiple timeframes: “Forex Gump” lets traders assess and execute transactions on numerous sizes.

Formulas at Work

The “Forex Gump” EA relies on algorithmic formulas. A simple EA example:

If 10-period moving average crosses above 50-period moving average Then Open a buy trade With Take Profit at 1.1250 and Stop Loss at 1.1100

The EA initiates a buy trade with defined Take Profit and Stop Loss settings if the short-term moving average crosses above the long-term moving average.

Pros and Cons

| Pros | Cons |

|---|---|

| 1. Automation Advantage: “Forex Gump” eliminates the need for manual execution, reducing emotional interference and allowing traders to execute strategies consistently. | 1. Market Risks: The EA is subject to market risks and cannot guarantee profits in all market conditions or sudden events. |

| 2. Precision: The algorithm aims to execute trades based on predefined conditions, reducing the potential for human error in execution. | 2. Learning Curve: While user-friendly, understanding and optimizing the EA’s settings may require some learning for novice traders. |

| 3. Time-Saving: The EA operates 24/5, enabling traders to capture trading opportunities without being tethered to their screens. | 3. Technical Issues: Technical glitches or connectivity problems can potentially affect rule execution and trading outcomes. |

| 4. Backtesting: The EA supports backtesting, allowing traders to evaluate its performance on historical data before deploying it in live trading. | 4. System Reliance: Relying solely on automated trading systems might limit a trader’s ability to adapt to changing market conditions. |

Starting Forex Gump EA

Download and Install: Download the “Forex Gump” EA from a trusted source and install it on MetaTrader 4.

Configuration: Set EA settings to match your trading strategy, risk management, and market circumstances.

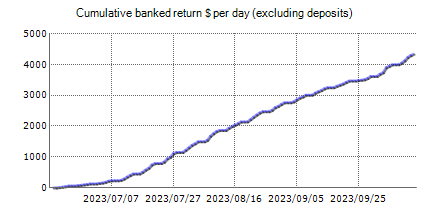

Testing and Optimization: Backtest the EA on historical data before live trading to evaluate its performance and adjust its parameters.

Monitoring: Track the EA’s performance and tweak its parameters when market conditions change.

Enhancing Forex Trading Experience

“Forex Gump” can automate forex trading, but you must grasp market dynamics and risk management first. Enhance your EA experience:

Education: Master forex trading, technical analysis, and risk management.

Strategy Refinement: Analyze and improve your trading tactics to meet your aims.

Continuous Oversight: Track your automatic trading and follow market mood.

Conclusion: Improve Forex Trading

Forex traders looking to automate their methods can consider the “Forex Gump” EA. Using its algorithms, traders may gain accuracy, time efficiency, and emotional control. Successful forex trading requires knowledge, risk management, and market adaptability. As you add “Forex Gump” to your trading arsenal, remember that although the EA might simplify execution, smart decision-making is still crucial in forex trading.