The guide was taken from tradersunion.

Using OpenAI’s ChatGPT to create a trading bot is a step-by-step method that mixes generative programming and natural language processing. Let’s examine each phase in more depth:

Sign up for an OpenAI account:

Go to the OpenAI website and create a free account. You may either enter your email address or select a simple login service like Microsoft or Google. You will need to register your phone number and use a confirmation code to confirm it in order to finish the setup. You will then be able to access the ChatGPT interface.

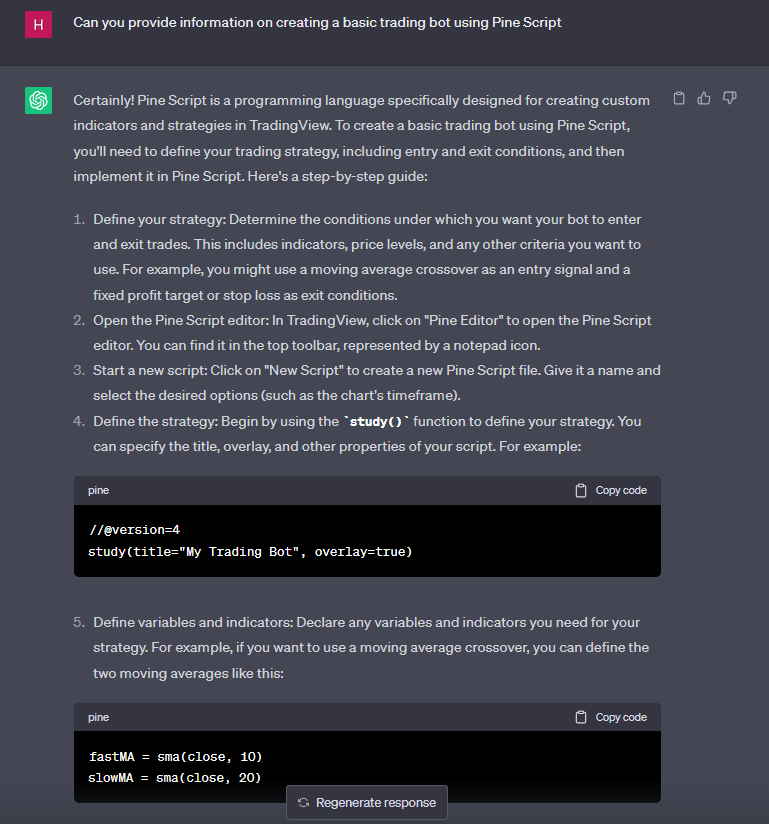

Interact with ChatGPT:

As soon as you are able to use ChatGPT, begin by entering a prompt that indicates what you want. In response, ChatGPT will provide pertinent data based on its expertise and experience. To obtain the desired outcomes, it’s critical to use creativity and try out various stimuli. If the first response falls short of your expectations, consider modifying your prompt or giving ChatGPT more details.

Example Prompt:

“Can you provide information on creating a basic trading bot using Pine Script?”

Request a trading bot code:

Based on your unique needs, ChatGPT may produce code snippets for trading bots. Even better, you may ask the model to write code in widely used trade languages like Python or Pine Script. Provide detailed instructions in your prompt on the features, metrics, or tactics you would like the trading bot to use.

Example Prompt:

“Please generate a basic trading bot code using Pine Script that includes a 200-day EMA moving average crossover strategy”.

Customize the generated code:

Once you receive the trading bot code from ChatGPT, go over it carefully and make any required adjustments to bring it more in line with your trading techniques and tastes. It’s important to realize that while though ChatGPT can provide code snippets, it might not always produce perfect or comprehensive code. Thus, in order to properly modify the produced code, you need have a fundamental grasp of programming and trading ideas. The trading bot code may be modified to include more indicators, risk management guidelines, or particular entry and exit circumstances.

Integrate the trading bot with a platform:

The trading bot code must be integrated with an appropriate trading platform after it has been modified. This might be an Amibroker platform, TradingView platform, or Binance cryptocurrency exchange, depending on your trading preferences. Integration may entail establishing authentication procedures, interacting with APIs, and comprehending the platform’s technical specifications.

Test the trading bot:

It’s critical to fully evaluate the trading bot’s operation and performance before to using it in a live trading environment. To assess the bot’s performance in varying market situations, you may either generate a simulated environment or use previous market data. Examine how well it generates trading signals and carries out trade execution. Make any required alterations or improvements to the code to improve its performance in light of the test findings.

Monitor and refine the trading bot:

After the trading bot is set up and trading, keep a close eye on its performance going forward. Analyze its trading performance on a constant basis, assess its risk-reward ratio, and check that it follows your established trading methods. Think of utilizing ChatGPT to get recommendations, direction, or additional help in honing and enhancing the trading bot’s features.

Creating an AI trading bot with ChatGPT involves using a sophisticated language model to assist in financial trading. While this approach has unique advantages, it also comes with certain limitations. Here are the pros and cons:

Pros

- Advanced Language Processing: ChatGPT’s ability to understand and generate human-like text allows for sophisticated interaction and analysis, which can be beneficial in interpreting market news and financial reports.

- Automation and Efficiency: An AI trading bot can operate continuously, making it possible to monitor markets and execute trades around the clock, far beyond human capabilities.

- Data Handling: ChatGPT can process large volumes of text data, providing comprehensive market insights that might be challenging to compile manually.

- Customizable Strategies: You have the flexibility to tailor ChatGPT’s prompts to suit your specific trading strategy and preferences.

- Educational Tool: For beginners, using ChatGPT in trading can be educational, helping them learn about market dynamics and trading concepts through interaction.

Cons

- ack of Real-Time Data: ChatGPT does not have access to real-time market data, which is crucial for timely and informed trading decisions.

- No Direct Trading Capabilities: ChatGPT can assist with analysis and suggestions, but it cannot execute trades on its own. It requires integration with other trading platforms.

- Potential for Misinterpretation: AI-generated advice is based on the data it was trained on and might not always be accurate or relevant to current market conditions.

- Risk of Overreliance: Relying too heavily on an AI for trading decisions can be risky, especially if it leads to ignoring fundamental market analysis and human intuition.

- Ethical and Regulatory Considerations: Using AI in trading raises questions about fairness, transparency, and regulatory compliance, which are yet to be fully addressed.

- Technical Expertise Required: Setting up and maintaining an AI trading bot requires a certain level of technical expertise in programming and understanding financial markets.